Taxation Of Expatriates In India - Everything You Need To Know

The Income Tax Act and Double Taxation Avoidance Agreement contain special rules to simplify the process of taxation for expats. It helps with ensuring that residents and non-residents of India are taxed fairly based on their income.

Understanding the provisions set by the central government will enable you to improve your tax liability and ensure proper compliance with Indian laws.

DSRV India has strived to help individuals like you gain a clear understanding of complex taxation laws by providing top income tax consultant Gurgaon services and erasing all queries and difficulties you may be facing with your taxable income.

Continue reading this blog as we delve deep into what taxes expatriates in India are liable to and how to understand the complex taxation laws in place within India.

What is Expatriate or Expat?

An expatriate is a person who is residing outside their home country or country of citizenship. They may be temporarily living in another country due to work reasons. They are not defined separately under the Income Tax Act, 1961.

Within India, however, they may be defined in two different ways. Firstly, an inbound expatriate, a resident of a foreign country who is currently working in India. Secondly, an outbound expatriate, who is an Indian resident working abroad.

Read More: Special Provisions for Non-residents under the Indian Income Tax Act

Double Taxation Avoidance Agreement (DTAA)

The central government of India introduced the Double Taxation Avoidance Agreement (DTAA) under section 90 of the Income Tax Act, 1961 so that individuals can avoid unnecessarily paying double taxes. India has formed DTAA with over 90 countries in total.

It is also important to determine the residential status under the DTAA with the country of the individual. An individual may also be a resident of two countries and might have to face the taxation laws of both respective countries.

A “Tie Breaker Rule” is applied under such circumstances to determine the residential status of the individual. This includes factors like nationality, permanent home, and other factors like habitual abode, centre of vital interest and competent authorities. Following the determination of the residential status, the individual may enjoy the following exemptions:

Other exemptions include employees of the government of another country who are involved in training in India under certain conditions, remuneration from embassies and consulates in India, and expats who need to stay within India and are entitled to ship stay exemption.

Tax Residency in India

An individual in India is required to pay in India based on their tax residency within an entire fiscal year. The fiscal year in India starts on 1 April and ends on March 31. The tax residency is dependent on how long an individual is staying within India.

The categories are Resident, Resident Ordinarily Resident (ROR), Resident but not Ordinarily Resident (RNOR) or Non-Resident (NR). We will explain each term in detail to help you understand tax residency and how expatriates are taxed based on it.

Read Also: A Detailed Guide on Form 15CA and 15CB for Cross-Border Payments

How To Determine The Residential Status

The residential status of an individual is determined under section 6 of the Income Tax Act, 1961 and the Double Taxation Avoidance Agreement (DTAA). As per the residential status, the taxation of the expatriate will be determined.

The residential status can be determined in the following ways:

- If the individual has resided in India for more than 182 days in the previous year

- If the individual has resided in India for more than 60 days in the previous year and more than 365 days in total in the last 4 preceding years.

If an individual of Indian origin has to work abroad during a financial year, then they will qualify as a resident only if they stay in India for more than 182 days. In such cases, individuals are allowed to stay in India for more than 60 days and less than 182 days.

However, if your income exceeds 15 lakhs within a year, then the period is reduced to 120 days. Furthermore, if the income of the individual exceeds 15 lakhs and is not liable to pay taxes in another country, then the individual will be considered a resident of India.

If the individual does not fulfil any of the mentioned criteria, then they will be considered as a non-resident of India.

Resident Ordinarily Resident and Resident Non-Ordinarily Resident

After determining whether the individual is a resident of India or not, you need to be able to determine whether they qualify as a Resident Ordinarily Resident (ROR) or Resident Non-Ordinarily Resident (RNOR). The individual will qualify as ROR if:

- They have been a resident of India for at least 2 years in the past 10 years in total.

- If they have stayed in India for at least 730 days in the past 7 years in total.

If the individual does not meet the criteria mentioned above, they will be categorised as a Resident Not Ordinarily Resident or RNOR.

An individual when categorised as RNOR or NR is not subjected to taxes in India if their income is received from outside India. Otherwise, if the income is to be received or accepted in India itself, then it will be taxable in India.

Taxation of Expatriates

The taxation of expatriates is known as “Expatriate Taxation”. Under the Income Tax Act of 1961, their taxation may be dependent on the following factors:

- The taxpayer’s residential status

- The provisions stated within the income tax slab within the Assessment Year

- The receipt and accrual of any income’s place and time

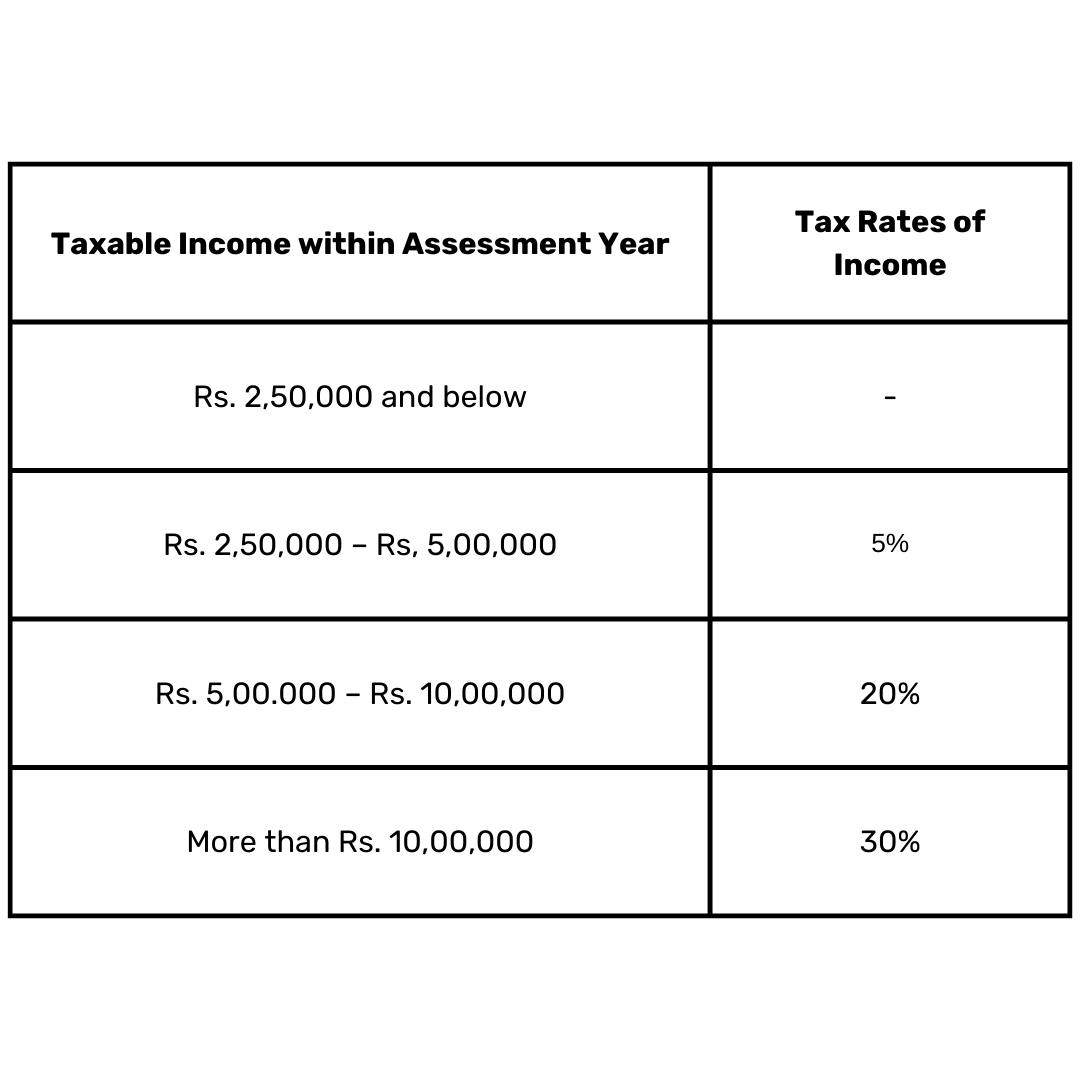

Tax Rates: The taxable income and income rates of expatriates are as follows:

The assessment year starts from April 1 and ends on March 31 the following year. Based on the ongoing financial year, the taxable income is determined and needs to be filed accordingly.

Conclusion

The most important determining factor behind the taxable income of expatriates is determining their residential status. Once it is determined, understanding the exemptions and other rules in place becomes much easier. The categorisations might feel complex at first, but they help ensure fairness within taxation for all individuals of varying residential statuses in India.

Do you need expert guidance on your taxable income in India? Reach out to us anytime at DSRV India, the top GST consultant in Gurgaon.