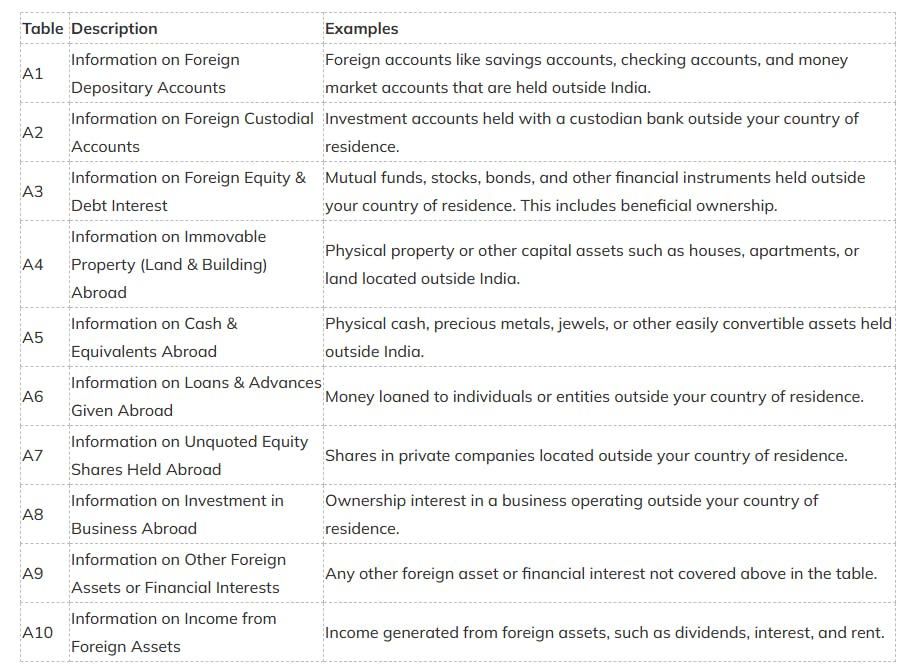

Disclosure of Foreign Assets in Income Tax Return: Schedule FA in ITR Filing

Did you know that not disclosing your foreign assets can lead to a penalty of ₹10 lakhs? Non-disclosure of foreign income and assets in income tax filing is considered a criminal offense by the Income Tax Department. The leading tax experts from the top chartered accountant firms in Gurgaon will explain the importance of the disclosure of foreign assets in income tax return filings. Read more here: