BUDGET BYTE – KNOW ABOUT NEW TAX REGIME VS OLD TAX REGIME?

If you are unaware of the changing tax regime. Then, DSRV India is here to solve your doubts about the new tax regime and old tax regime in this blog.

If you are unaware of the changing tax regime. Then, DSRV India is here to solve your doubts about the new tax regime and old tax regime in this blog.

0-3 Lakh: No Tax

3-6 Lakh: 5%

6-9 Lakh: 10%

9-12 Lakh: 15%

12-15 Lakh: 20%

Above 15 Lakh: 30%

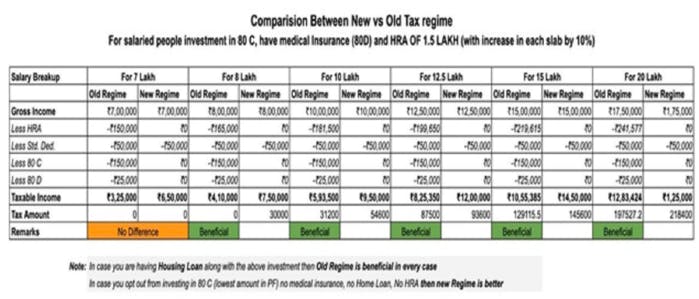

Hence, Government wants to promote new tax regime claimed to be simple tax services with lesser tax rates but without exemptions and deductions. Our analysis shows that if one is claiming deduction of HRA, investments u/s 80C and medical insurance u/s 80D, then in most of these cases old regime will be the obvious choice of an Individual. The default tax regime will be the new tax regime and one has to choose the old tax regime by filling a form unlike presently.

Confused about Input Tax Credit (ITC) for exporters with foreign expenses? Understand ITC issues and navigate GST for export of goods & services.

What's new in compounding under FEMA? Learn about recent changes in compounding mechanism for contravention under FEMA (Foreign Exchange Management Act).

Understand how Indian companies can leverage Overseas Direct Investment (ODI) for investment abroad. Explore the ODI framework for investing outside India.