Who Is A Virtual Chief Financial Officer (CFO)?

A CFO is a forerunner who makes critical financial decisions in times of uncertainty in businesses. However, as we have already mentioned, not every business has a high budget to hire a full-time or in-house CFO, especially startup businesses.

Therefore, hiring a Virtual Chief Financial Officer (CFO) through outsourcing services can equally provide professional expertise in the financial aspects of the business. They are beneficial for startups and small businesses required to keep fixed low costs.

Even large corporations may hire virtual CFOs for their subsidiary businesses, even after having a full-time employee CFO. So, if you are running a startup in India and you hesitating to hire a full-time or part-time CFO for a huge cost. Then, hiring a virtual CFO through outsourcing can be your best option to optimize your financial management and cover the grey areas of your business.

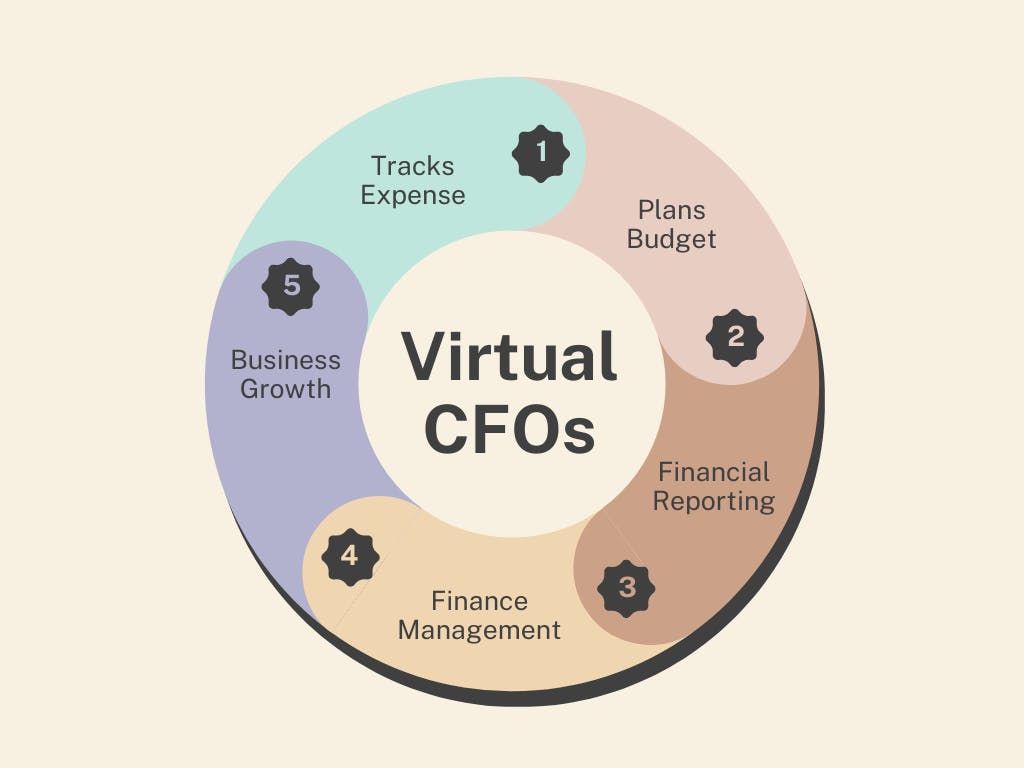

Their task in the financial reporting of an organization includes cash flow management, tax filing, compliance management, budgeting, transfer pricing study report analysis, and more.

Thus, hiring virtual CFOs can help you meet your business's short-term and long-term goals at relatively low costs.

So, discover the benefits of hiring a virtual CFO with one of the top chartered accountant firms in Gurgaon.

Read Also: Start Your Indian Start-up Successfully With These Insider Tips!

Optimize Success: What Are The Benefits Of Hiring A Virtual CFO?

1. Cost-Effective Solution

One of the top benefits of hiring a virtual CFO is a cost-cutting solution for startups in India. It gives you the flexibility of not bearing the high salary of a full-time senior CFO. You can avail of the same financial services from a virtual CFO at a low cost and according to your business needs.

2. Expertise In Financial Management

The first thing that, you must be thinking of is if a virtual CFO has the same expertise as an in-house CFO or not, right?

Well, virtual chief financial officers have years of experience in managing the financial aspects of various industries. Thus, they can provide you with financial planning that is tailored to meet your specific business goals.

3. Enhances Flexibility

Virtual CFOs are highly flexible for startup approach, apart from providing monetary benefits. For example, you can hire them for a few hours in a week to stay updated about the evolving changes in the industry. Or, you can also take the help of a virtual CFO to meet your financial business goals. And, once you have reached your goal, your virtual financial advisor can resume his work on the next financial objective of your company.

This will give your organization solid access to actionable management in no time.

4. Enriched Scalability

Your financial goals do not remain the same from when you started your start-up. It usually evolves with constant growth and time. As a result, your startup in India needs scalable financial advice and planning to grow bigger.

Thus, the benefits of hiring a virtual CFO give you access to scalable solutions that can adapt fast to your changing business requirements.

5. Use Of Advanced Technology

As virtual CFOs work on a contractual or part-time basis for various industries. They are always up-to-date with using the latest tools and software for improving efficiency, mitigating financial risks, and streamlining processes for your business's performance.

6. Risk Management

Corporations and businesses have several underlying financial risks that can ruin your business in no time if you do not handle them properly. Therefore, virtual CFOs employ strategies that mitigate financial risks for long-term business success.

They can also help you to stay protected from uncertain threats in the business paradigm.

7. Reduces Loss And Improves Profit

Virtual CFOs are the best solution for you if you want to scale your business with higher profitability. They make sure to provide financial planning for your startup which includes making more profit than what you are spending.

They take charge of how much money your startup gains in a period and how much money goes out.

8. Improvement In Decision Making

If you are running your start-up without a CFO due to high cost, then, it is time that you hire a virtual CFO for your organization. Running a business without a CFO can be vulnerable which includes risks like faulty transactions, lack of financial control, taxation risks, and missing business opportunities.

So, if these are the reasons that send shivers down your spine. then, a virtual CFO with up-to-date financial planning. So that, you can make better decisions to bring a positive impact to your business's bottom line.

9. Supports Compliance And Regulations

Is it a daunting task for you to understand the complexity of the business regulatory landscape?

Don't worry! Virtual CFOs make financial plans in adherence to tax laws and standard compliance regulations. Which can reduce the risk of financial penalties and fines for your startup.

10. Debt Assessment

At present, businesses are facing immense problems in raising funds which require updated financial strategies. Therefore, a virtual CFO can provide you with timely insights on how to recover existing debts and cost improvement methods.

They also suggest preparing financial documentation to get more funds from private equities.

11. Improves Budgeting And Accounting

Whether you are running a startup or a large business, you need to make sure that your money is well-managed. Thus, the benefits of hiring a virtual CFO give you the freedom to business develop in the future with accurate accounting and budgeting plans.

12. Relationship Building In The Business Landscape

The core of a business foundation is how you develop relationships with other people. These people are the ones that can help your business grow like money lenders, investors, bankers, and stakeholders.

Thus, virtual CFO services provide establishing your business with good relationships. So that, you do not have to face problems in raising funds and loans. In addition, virtual CFOs also strategically engage with bankers to find a common ground for raising loans faster.

13. Focus On The Core Financial Functions Of A Business

By taking the help of virtual CFO support, you can achieve business strategies and growth. Rather than, bogging yourself down with financial administrative tasks.

As virtual CFOs handle all the financial tasks that can make your business prosper in the changing business world.

Read More: Skyrocket Your Savings By Learning About Input Tax Credit Under GST

Choose DSRV India's Virtual CFO Assistance For Business Success

Now that you know the benefits of hiring a virtual CFO, don't let your business finances stress you down with worries. We at DSRV India provide data-driven financial insights, strategies, and solutions tailored for your business growth.

So, let our expert team handle and manage your startup's finances seamlessly!